The filling out the texas 203 is very simple. Our experts ensured our editor is not hard to utilize and can help prepare any kind of form in no time. Take a look at some of the steps you'll want to take:

Step 1: On the website page, select the orange "Get form now" button.

Step 2: You are now on the form editing page. You may edit, add text, highlight particular words or phrases, put crosses or checks, and include images.

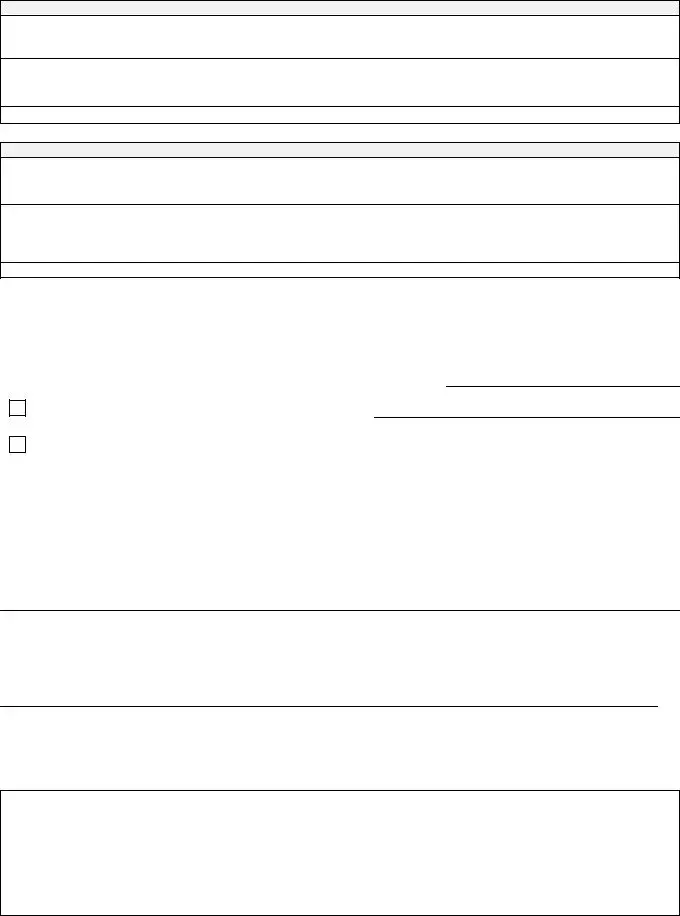

For you to prepare the template, type in the details the software will require you to for each of the next parts:

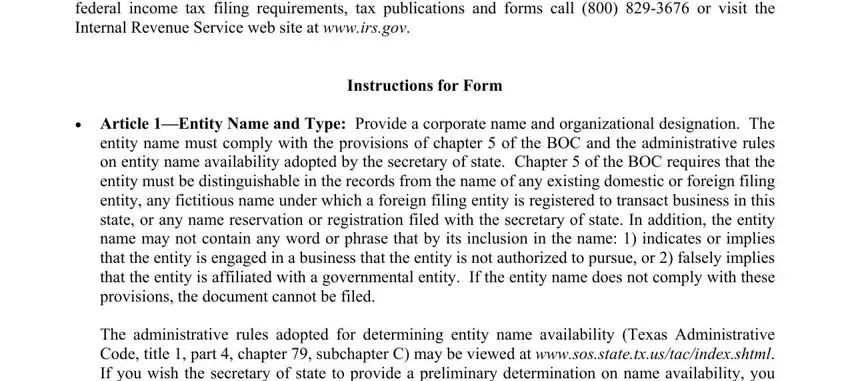

In the The administrative rules adopted, Form, and Instruction Page Do not submit field, note your details.

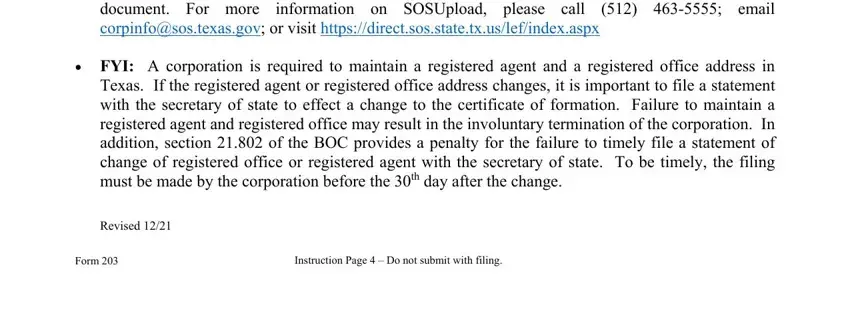

You may be requested for some important details so that you can fill up the Need Faster Delivery and, FYI A corporation is required to, Revised, Form, and Instruction Page Do not submit field.

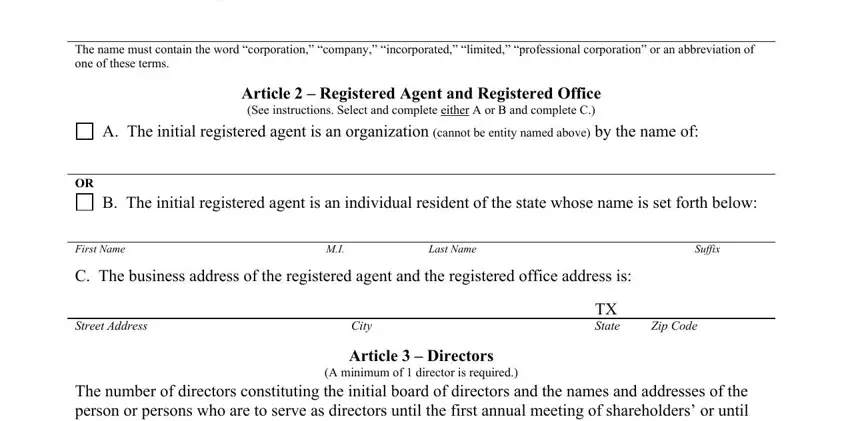

In box The name must contain the word, Article Registered Agent and, A The initial registered agent is, B The initial registered agent is, First Name, Last Name, Suffix, C The business address of the, Street Address, City, TX State, Zip Code, Article Directors A minimum of, and The number of directors, specify the rights and obligations.

Look at the fields First Name, Last Name, Suffix, Street or Mailing Address, City, State, Zip Code, Country, and Form and thereafter fill them out.

Step 3: As soon as you select the Done button, your ready form can be easily transferred to any of your devices or to email chosen by you.

Step 4: Generate copies of the form - it may help you stay away from forthcoming concerns. And don't get worried - we do not disclose or look at your details.

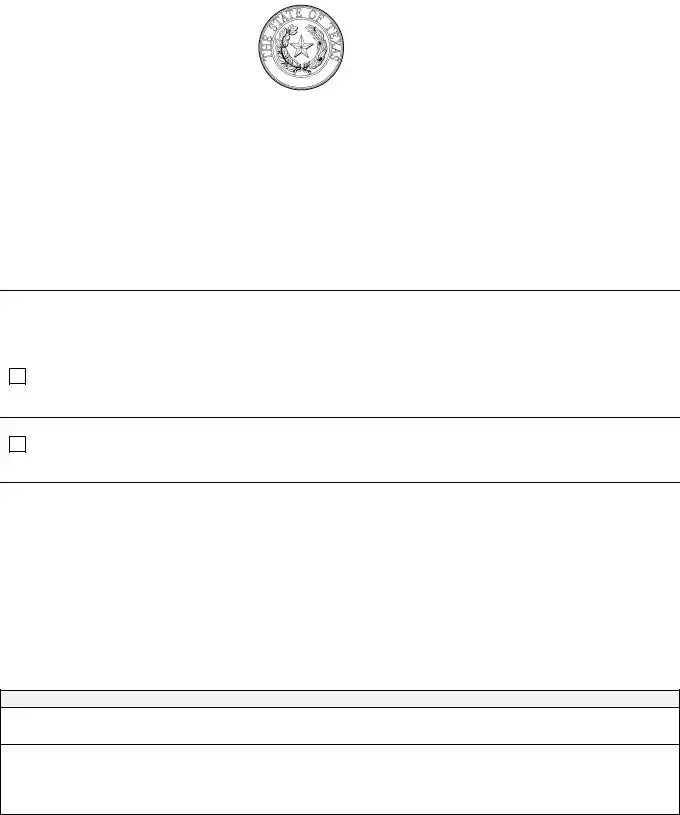

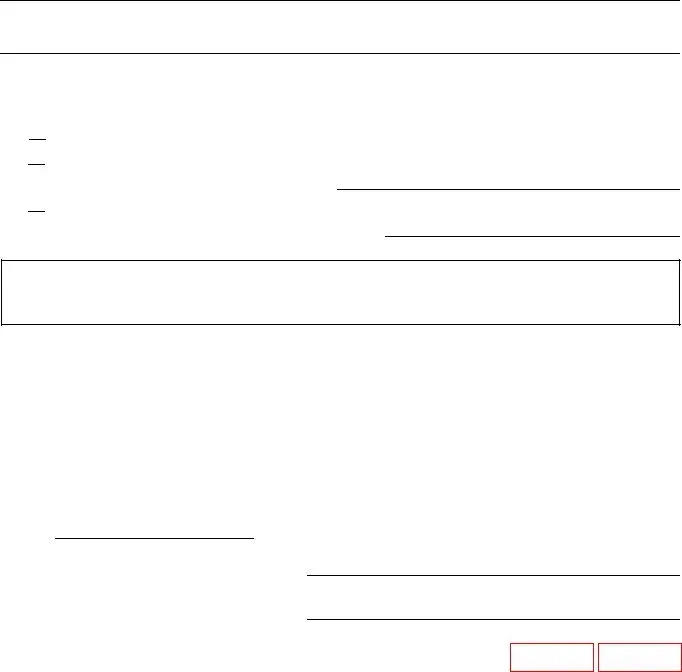

This document becomes effective when the document is filed by the secretary of state.

This document becomes effective when the document is filed by the secretary of state. This document becomes effective at a later date, which is not more than ninety (90) days from the date of signing. The delayed effective date is:

This document becomes effective at a later date, which is not more than ninety (90) days from the date of signing. The delayed effective date is: This document takes effect upon the occurrence of a future event or fact, other than the passage of time. The 90

This document takes effect upon the occurrence of a future event or fact, other than the passage of time. The 90